What is the 971 IRS Code?

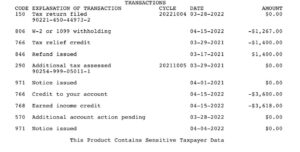

The 971 IRS code is an internal transaction code used by the Internal Revenue Service (IRS) to denote specific actions taken on a taxpayer’s account. This code plays a crucial role in tax reporting as it communicates significant information regarding a taxpayer’s financial obligations or entitlements. When taxpayers engage with the IRS—whether through filing a return, making payments, or responding to inquiries—the 971 code may appear in their account activity, indicating a specific transaction or adjustment has occurred.

Common Reasons for the 971 IRS Code to Appear

The 971 IRS code serves as a significant indicator within the realm of tax administration, often highlighting various circumstances that affect a taxpayer’s file. One of the most prevalent reasons for the appearance of the 971 IRS code is an audit. When the Internal Revenue Service (IRS) selects a taxpayer’s return for audit, adjustments and inquiries may lead to the activation of this specific code. This scenario emphasizes the importance of maintaining accurate records and timely responses to any IRS communications, as discrepancies can result in further complications.

Another common cause for the 971 IRS code is the identification of errors on previous tax returns. Taxpayers may unintentionally report incorrect information, leading to adjustments by the IRS that are reflected in the coding. A practical example of this situation involves a taxpayer who realizes that they unintentionally omitted a source of income. Upon correcting this oversight, the IRS updates the taxpayer’s status, which is then documented via the 971 code in their tax record.

In addition to audits and errors, changes in taxpayer information can also trigger the 971 IRS code. This may include scenarios such as name changes due to marriage or divorce, or changes in address. When any of these updates are processed by the IRS, they create a necessity for a review of the associated tax liability, facilitating the need for this particular code.

Lastly, the IRS may apply the 971 code in response to new documentation submitted by the taxpayer, which necessitates adjustment of previously reported information, such as a corrected W-2 form. These situations highlight the importance of proactive communication with the IRS to minimize potential issues that may arise from misunderstandings or late submissions. Understanding these common scenarios provides clarity for taxpayers, enhancing their preparedness for potential interactions with the IRS.

How to Respond to the 971 IRS Code

Encountering the 971 IRS code in your tax documents can be alarming. This code indicates that the IRS has taken a specific action regarding your tax account, often relating to adjustments, corrections, or other matters requiring taxpayer attention. It is crucial not to ignore this notification, as it may have significant implications for your financial situation or future tax obligations.

The first step to take when you see the 971 IRS code is to review your tax documents thoroughly. Understanding what the code refers to, particularly the exact nature of the adjustment or action taken, can help you formulate an appropriate response. If the information is unclear, reaching out to the IRS directly is the best course of action. You can contact the IRS at their official phone number or through their website, where you may find additional resources related to code 971.

When communicating with the IRS, it is important to document all interactions meticulously. Note the date, time, and details of conversations or correspondence. This can be invaluable in case of further proceedings or disputes regarding your tax status. If the IRS requests additional information or documentation, gather the necessary documentation to ensure that your response is prompt and comprehensive.

Furthermore, it is advisable to understand the implications of the 971 IRS code on your tax situation. This code may require you to take specific actions, such as filing amended returns or providing clarifying information about your previous filings. Prepare your materials carefully, and consider seeking assistance from a tax professional if the situation becomes complex. This proactive approach will help you navigate the potential challenges associated with the 971 IRS code and maintain the integrity of your tax filings.

Tips for Managing IRS Notices and Codes Effectively

Managing IRS notices and codes, including the crucial 971 IRS code, can be a daunting task for many taxpayers. However, employing effective strategies can significantly ease the burden associated with tax compliance. One of the most fundamental approaches is to maintain organized tax records. Consistently documenting financial transactions, receipts, and other pertinent information allows individuals to readily access necessary data, especially in the event of an IRS inquiry. By creating folders for different tax years and categories, taxpayers can streamline their record-keeping process and be well-prepared for any issues that may arise.

Another vital tip is to seek professional tax assistance when required. Understanding the complexities of the 971 IRS code and other related regulations can be challenging, particularly for individuals without a legal or financial background. Tax professionals can not only clarify any confusing language but also provide guidance tailored to one’s unique financial circumstances. Engaging a certified public accountant (CPA) or tax advisor can ensure that all tax obligations are met and help optimize potential deductions and credits.

Staying informed about one’s tax rights is another proactive strategy for managing IRS notices. It is essential to familiarize oneself with the taxpayer bill of rights, which outlines fundamental rights and protections afforded to taxpayers. Knowing what rights are available can boost confidence when interacting with the IRS and help prevent miscommunication.

Developing a proactive mindset towards tax obligations can also minimize anxiety and promote compliance. This means regularly reviewing one’s tax situation throughout the year rather than waiting until tax season approaches. By monitoring finances and understanding the implications of the 971 IRS code and associated notices, taxpayers can navigate their responsibilities with greater ease and assurance. Finally, utilizing available resources, such as IRS publications and reputable online platforms, can enhance one’s knowledge and preparedness when taking on tax matters.